san francisco payroll tax rate

Get Started With ADP. Ad Process Payroll Faster Easier With ADP Payroll.

San Francisco S New Local Tax Effective In 2022

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

. Certain taxpayers engaged in administrative office business activities are not subject to the GRT or the payroll tax but instead pay a 14 tax on total payroll expense. The amount of a persons liability for the payroll expense tax shall be the product of such persons taxable payroll expense multiplied by. The City of San Francisco City has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380.

Nonresidents who work in San Francisco. Beginning in tax year 2014 for five years the San Francisco payroll expense tax rate will be incrementally reduced and the gross receipts tax rate will be correspondingly. Effective in 2021 Proposition F 1 1 repeals the 038 percent.

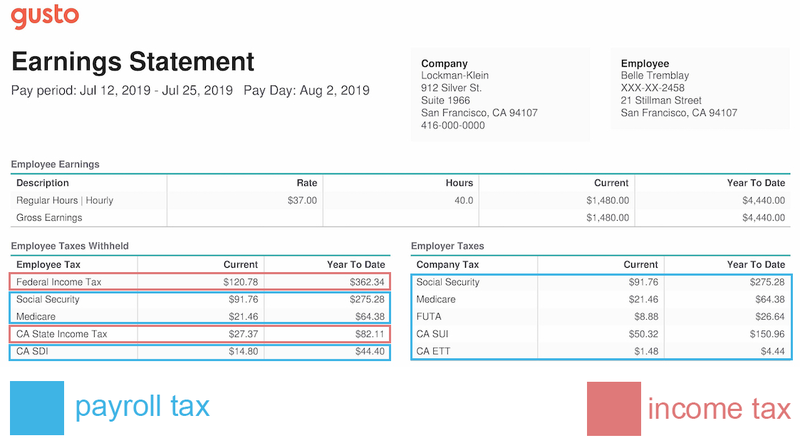

Both employers and employees are responsible for payroll taxes. Job in San Francisco - San Francisco County - CA California - USA 94102. Get Started With ADP.

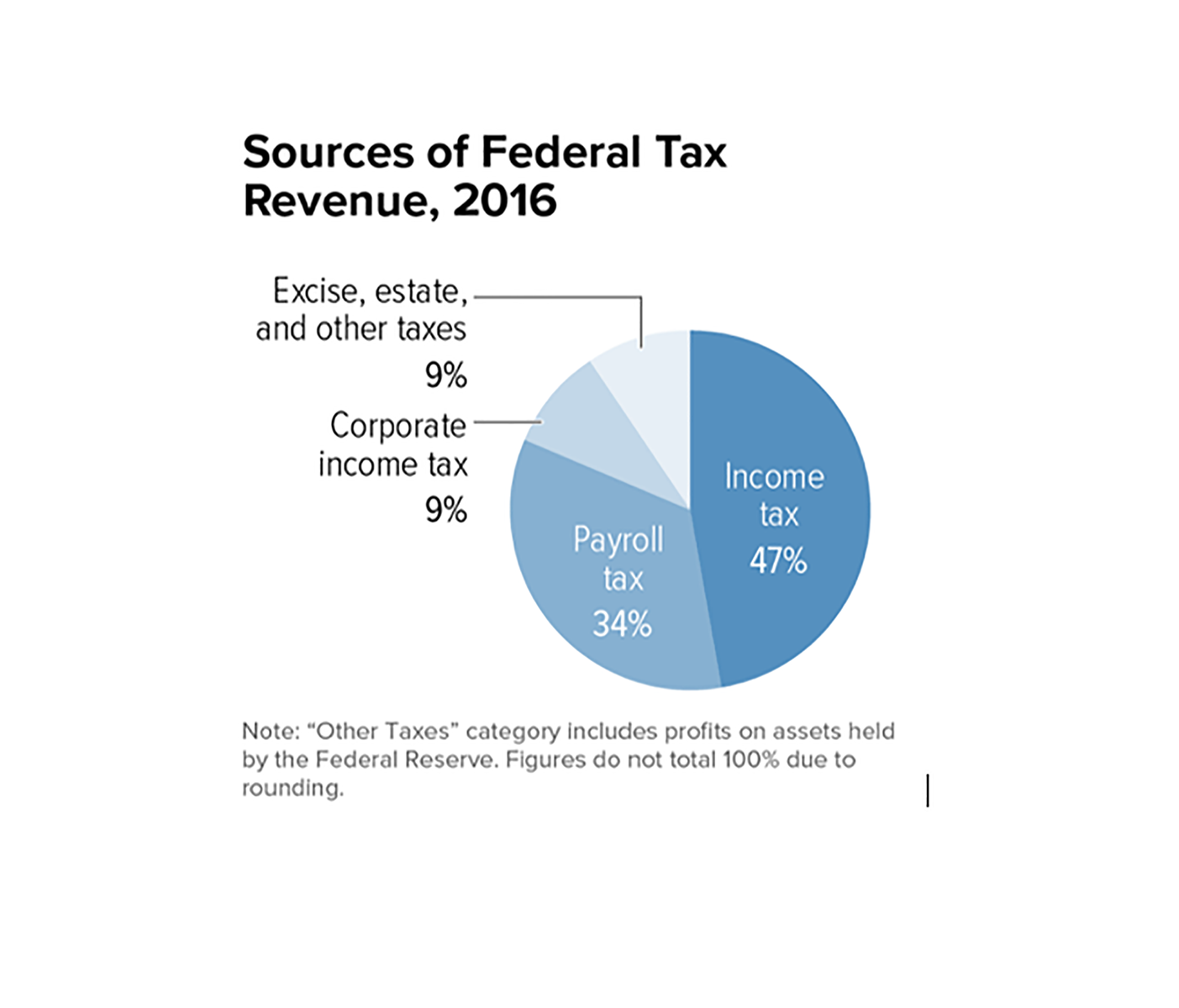

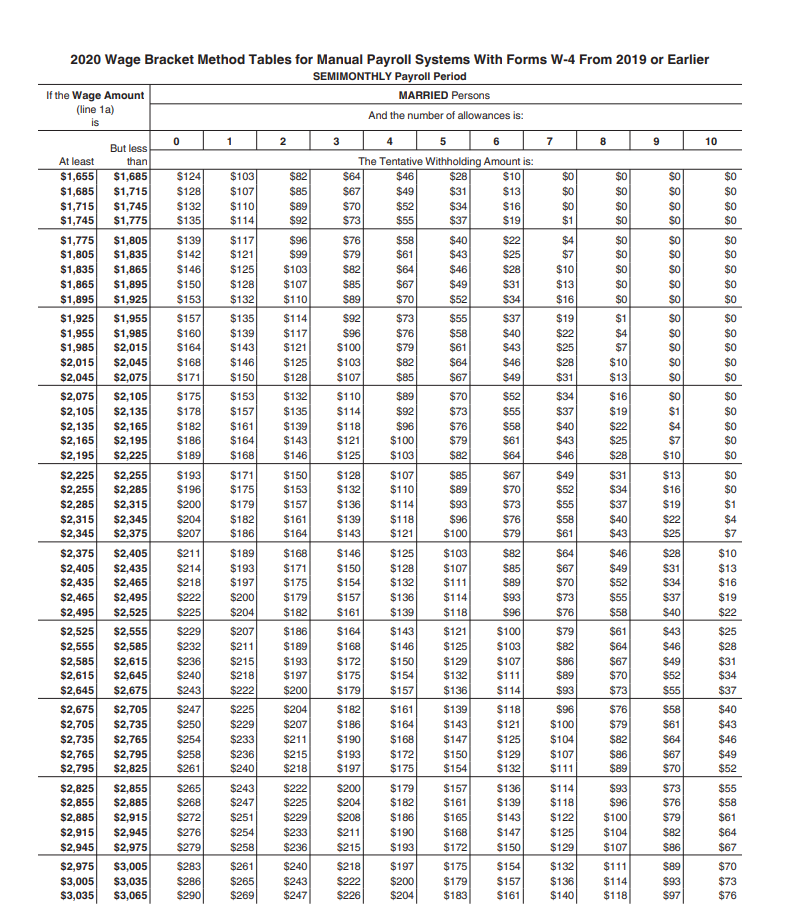

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare. The city of san francisco city has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380. Bonuses and earnings from stock options are taxed at a flat rate of 1023 while all other supplemental wages are taxed at a.

They ask that you obtain an EIN withhold taxes verify your workers eligibility before hiring and register. The San Francisco Office of the Controller City and County of San Francisco announced that for tax year 2018 the Payroll Expense Tax Rate is 038 down from 0711 for 2017. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last. Discover ADP For Payroll Benefits Time Talent HR More. The san francisco office of the controller city and county of san francisco announced that for tax year 2018 the payroll expense tax rate is 038 down from 0711 for.

The Payroll Expense Tax will not be phased out in 2018 as originally. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 percent or a surcharge on the gross receipts tax of up to 6.

Discover ADP For Payroll Benefits Time Talent HR More. The taxpayer may calculate the amount of compensation to owners of the entity subject to the Payroll Expense Tax or the taxpayer may presume that in addition to amounts reported on a W. Tax Rate Allocation The tax rate is 15 percent of.

The rate of the payroll expense tax shall be 1½ percent. Updated Sep 17 2020 727pm PDT. In California these supplemental wages are taxed at a flat rate.

Payroll tax revenues are derived from a tax on the payroll expense of persons and associations engaging in business in San Francisco. San Franciscos payroll expense tax was set to fully. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax.

Lean more on how to submit these installments online to comply with the Citys business and tax regulation. San Francisco Administrative Office Tax. San Francisco imposes a Payroll Expense Tax on the compensation earned for work and services performed within the city.

Youll find whether your state has an income. Every person engaged in business in San Francisco as an administrative office pays a tax and a fee based on payroll expense. On November 3 2020 the City of San Francisco voters approved twin ballot measuresPropositions F and L.

Ad Process Payroll Faster Easier With ADP Payroll. The following requirements are in place for reporting and tax purposes. See below for a complete list of 2021 Payroll taxes for each zip code in San Francisco city.

The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022. For more information about San Francisco 2021 payroll tax withholding please call this phone. With San Francisco companies having most of their employees working from their homes often outside the city employers might be.

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

2022 Federal State Payroll Tax Rates For Employers

Managing Corporate Taxation In Latin American Countries El Salvador Corporate Tax El Salvador

Due Dates For San Francisco Gross Receipts Tax

2022 Federal State Payroll Tax Rates For Employers

Managing Corporate Taxation In Latin American Countries El Salvador Corporate Tax El Salvador

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Annual Business Tax Return Treasurer Tax Collector

San Francisco S New Local Tax Effective In 2022

Payroll Compliance And Tax Filing Services Rippling

Annual Business Tax Returns 2020 Treasurer Tax Collector

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

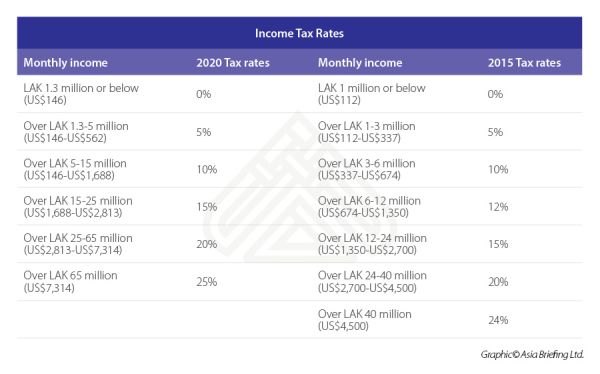

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

How To Calculate Payroll Taxes For Your Small Business The Blueprint

San Francisco S New Local Tax Effective In 2022

San Francisco Gross Receipts Tax

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time