september child tax credit payment date

The IRSs statement reads. The Estimated Refund Date Chart Is Below If You Just Want To Scroll Down.

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

29 What happens with the child tax credit payments after December.

. To start a payment trace mail or fax a completed Form 3911 Taxpayer Statement Regarding Refund. Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. 15 opt out by Nov.

The first two checks were sent out in July and August but theres still another to come in September and the following months. Find out more about that here. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

Millions of families across the US will be receiving their third advance child tax credit payment next week on Sept. For the first time since july families are not expected to receive a 300 payment on january 15 2022. Many parents have been spending the money as soon as they get it on things like rent and uniforms and already the payments have helped fewer children go hungry.

Who is Eligible. Enter Payment Info Here tool or. 15 opt out by Aug.

Payments will start going out on September 15. 15 opt out by Nov. September Advance Child Tax Credit Payments.

Advance payments will continue next month and through the end of the year thanks to the American Rescue Plan passed back in March. Includes related provincial and territorial programs. The deadline for the September payment has passed You can use the IRS Child Tax Credit Update Portal online anytime between now and December to unenroll.

Payments will start going out on September 15 More than 30million households are set to receive the payments worth. 9 weeks since the payment was mailed and you have a foreign address. December 13 2022 Havent received your payment.

The next deadline to opt out of monthly payments is Oct. This months payment will be sent on September 15. Find out when your tax credits payment is and how much youll get paid.

2022 irs tax refund dates. 4 at 9 pm. Many payments are automatic and based on information the IRS has from your 2019 or 2020 tax returns whichever has been processed.

You could be getting up to 300 for each kid under 6 years old and 250 for. 15 opt out by Oct. The IRS is relying on bank account.

You may want to unenroll if you dont meet income or other eligibility requirements. 13 opt out by Aug. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

September 20 2022. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in Jan 10 2022 The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is Monday April 18 2022 for most taxpayers. But the payments havent been without their glitches.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. Families with kids under the age of six will receive 300 per child. The next child tax credit payment is coming to eligible parents bank accounts in just a few days.

These calendars include the due dates for. The IRS said Wednesday that Septembers payments totalling nearly 15 billion have been sent. When does the Child Tax Credit arrive in September.

The IRS issued a formal statement on September 24 which anyone missing their September payment should read. IR-2021-188 September 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. Those with kids between ages six and 17 will get 250 for every child.

The bottom line here there. Families can use the Child Tax Credit money however they like. The current scheme allows families to claim up to 3600 per child under six and 3000 for dependents aged six to 17.

Child tax credit payments are due to come in on the 15th of each month Credit. With just three payments left in 2020 some politicians are making a push for this tax credit to continue. The next round of payments will be Oct.

During the week of September 13-17 the IRS successfully delivered a third monthly round of approximately 35 million advance Child Tax Credits CTC totaling 15 billion. Tax credit payments are made every week or. The IRS will deposit the next advanced child tax credit payment on September 15 which the funds should appear in your bank account in a few days at max.

More than 30million households are set to receive the payments worth up to 300 per child starting September 15. Goods and services tax harmonized sales tax GSTHST credit. After that only two more checks will be sent in 2021 for November and December with the rest of.

September 17 2021 Getty Images The IRS sent out the third child tax credit payments on Wednesday Sept. The next child tax credit payment is due to arrive on Oct. Child tax credit 2022 deposit dates.

The third payment date is Wednesday September 15 with the IRS sending most of the checks via direct deposit. Wait 5 working days from the payment date to contact us. 935 et dec 29 2021.

In most cases the funds will be deposited into your bank account right after the IRS sends them or in a few hours depending on the bank. The child tax credit benefits are a part of President Joe Bidens American Rescue plan which was signed into law in March. The IRS has announced the September child tax credits are on their way and future payment dates.

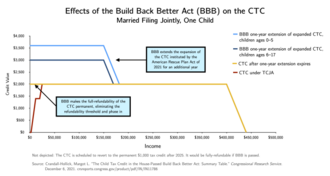

Democratic lawmakers are looking to extend the advance credit through 2025.

One Week Left To Renew For 300 000 Tax Credits Customers Gov Uk

The Next Child Tax Credit Payment Pays Out Aug 13 Here Is What You Need To Know Forbes Advisor

Extension Of 500 Payment For Working Households On Tax Credits Low Incomes Tax Reform Group

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit United States Wikipedia

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Child Tax Credit United States Wikipedia

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit United States Wikipedia

Tax Credits Childcare Support Low Incomes Tax Reform Group

December Child Tax Credit Why Some Parents Were Only Paid Half And What To Do If You Didn T Get It At All

2 Child Limit Policy Low Incomes Tax Reform Group

Child Tax Credit United States Wikipedia

Have You Received An Additional Letter About Your Tax Credit Renewal From Hmrc Low Incomes Tax Reform Group